A recent study showed that 19% of Americans have nothing set aside to cover an unexpected emergency. 31% of Americans have less than $500 in savings. And then 49% of American are anxious about their financial well-being. It means that half of the people in the U.S. Are living from the paycheck to paycheck. That’s one important reason why I want to teach you How to Save 1000€ a Month.

NOTE: I am using euros on this article because I am living in Europe I am more familiar with them. 1000€ = $1128. So saving $1000 should be even much easier.

I am not going to tell how somebody could make it only in theory. I am saving 1000€ each and every month. In addition, my savings per month are getting rapidly much higher because my income from this and other websites is going up. But you don’t need to know anything about websites if you want to save 1000€/month.

Saving +1000€ a month is simple. Your income must be 1000€ higher than your earnings.

If your income is too low, you need to raise your income. If your expenses are too high, you need to lower your expenses. I know it’s easier said than done but now we have a clear goal in mind that makes it much easier to achieve.

Let’s start first by increasing your income.

How to Increase Your Income?

Do you know where getting your raise starts? From your mind. That’s why one of the most famous books in managing money with more than 15 millions sales worldwide is called Think and Grow Rich. It’s not called Work Hard and Grow Rich. Or Save Lots of Money and Grow Rich. No. It’s called THINK and Grow Rich.

Success coach Brian Tracy says that the highest paid job in America is thinking. What is the difference between a 40-year-old guy who earns $200,000/year and a guy who earns $20,000/year working in Walmart? The first one decided to think while the second one didn’t.

That was a “theory part”. You need to get your mindset right to save 1000€ a month. Jim Rohn teaches the important principle for earning money, “You get paid for the VALUE that you bring to the marketplace.” It means that the guy who brings more value earns more than the guy who doesn’t bring any value.

Now, let’s get into more practical things.

7 Practical Tips to Raise Your Income

1.Make more sales/better results

If you are a salesperson, bringing more value for your company means making more sales. If you are now making 30 sales per month you could raise your income by making 40 sales per month.

In many jobs you can measure your job like this. When you have raised your level, you can immediately go to your boss and ask for more money. If he doesn’t pay more, look for another job because somebody will for sure pay for a great employee.

2.Do affiliate marketing online

Affiliate marketing means that you promote other people’s products and earn income. You can do it through a blog, website, social medias, email, in real life by recommending products to your friends and so on.

There are no income limits with affiliate marketing. Some people make +$10,000/month online but there are also guys who make +$100,000/month with affiliate marketing.

If you want to learn more how you could make big bucks with affiliate marketing, have a look at this FREE step-by-step training.

3.Accomplish mini tasks to earn extra money

I don’t do this myself because the earning potential is much greater in affiliate marketing. Still, I know that many people worldwide are doing mini tasks like online surveys, watching videos, loading apps, etc. to earn some pocket money every month.

The best sites for doing this are probably Clixsense and PrizeRebel.

4.Start a blog/website

This is many times closely related to affiliate marketing. If you haven’t build a website before, here are my step-by-step instructions how you can do it 30 SECONDS.

With a blog you can earn income from ads, by selling your products, promoting other people’s products and much more. I have also written an article which explains how long does it take to make money with blogging LINKKI and how you can speed upt the process.

5.Invest in Stock Market

This is one of the easiest but still a profitable way to increase your income. Nowadays you can start even for 15€/month. Over the time course this will generate a good amount of extra income and probably one day you are able to retire because of your savings in stocks.

If you are living in Scandinavia, my recommendation is to invest through Nordnet Bank. I am using it myself and I have been greatly satisfied.

6.Buy an investment apartment

Robert Kiyosaki’s rich father taught him like this: You can either buy one big house for yourself and for your family or you can buy one apartment for your family and rent two apartments for other people.

1 big for yourself or 1 small for yourself + 2 investments that bring you the extra income. That’s the choice you should make. I can say from my own experience that buying an investment apartment is a very profitable and an easy choice.

7.Buy bitcoins (or another cryptocurrency)

Have you ever heard of bitcoins? Have a look at my article where I explain what are bitcoins and how to make money with them. You can also go straight to my article where I explain how you can get a $10 bonus through my link immediately.

Which one of these 7 methods do you like the most? Do you find them useful?

All of those methods that I mentioned above work and I have been using all of them myself successfully. Even though some investing may take a little while to pay off, it will become a big income source in the long run. Paycheck will make you a living but a business or investing will make you a fortune.

Now let’s get to the second part which is usually even faster to execute. By raising your income, saving money is easier and become more comfortable but by cutting your expenses, you can quickly raise the amount that you have left every month for your investments.

7 Ways to Cut Your Expenses Easily

I will present some ultimately practical and profitable ways to cut your expenses. I am using this myself actively

1.Get rid of the car

Have you ever calculated how much money you are paying for your car every year?

- The money that you paid for the car when buying it

- Insurances

- Gasoline

- Car Taxes

- Repairs

- Road tolls

I recommend you to count all the expenses. I guess you will be surprised. But I recommend you to sit down before doing that because it may be so big amount of money that you pass out.

You may be wondering how you can get to different places without a car. That’s a good question and I have a good answer. I have never needed a car during my life even though I have never lived in a big city. Currently, I am living in a “city” of 20,000 people and the distance to my workplace is 20km.

Now I am using a train or carpooling to get there and it’s almost as easy as I would have my own car. I go to the gym or to the supermarket by walking and so on.

When I was in Finland and my distance to the workplace was only 11,5km I went it by bike.

2.Move to a Cheaper Apartment

I like living in a small apartment right now. It takes 5 minutes to clean the whole apartment because it’s so small. I don’t need to use my valuable time on cleaning as I would need to use in a big 100m2 house.

I looked for the cheapest apartment in town and moved here. By changing your place to live, you can save thousands of euros per year. If you move to a smaller apartment, the change may feel strange in the beginning but you will get used to it very quickly.

Your happiness doesn’t usually depend on how big is your house. In addition, I am much happier now in a smaller apartment than I would be in a big house.

3.Think what you are buying in the grocery store

I eat porridge/oatmeal every day at least one plate. Sometimes I eat it even 2-3 plates per day. 500kg of oatmeals cost 0,39€-0,55€ in Lidl. Basically, it’s almost free. If I would eat only oatmeals, my daily meals would cost probably less than 1 euro!

Okay, you don’t need to eat oatmeal every day to save money on groceries. But you can make a little bit of thinking what you are buying. Do you really need the most expensive meat? Could you save 100€ per month (=1,200€/year) by going to Lidl instead of Interspar or another grocery store? With little changes you can make a big difference over the time course.

Eating cheap doesn’t mean eating unhealthy. Many healthy foods are very cheap. Oatmeals, eggs, bananas and other fruits, cucumber, tomatoes and many other vegetables, cottage cheese, milk, rye bread and so on. You can actually have a delicious and a healthy meal for a cheap price.

What are you eating every day?

4.How often do you buy new clothes?

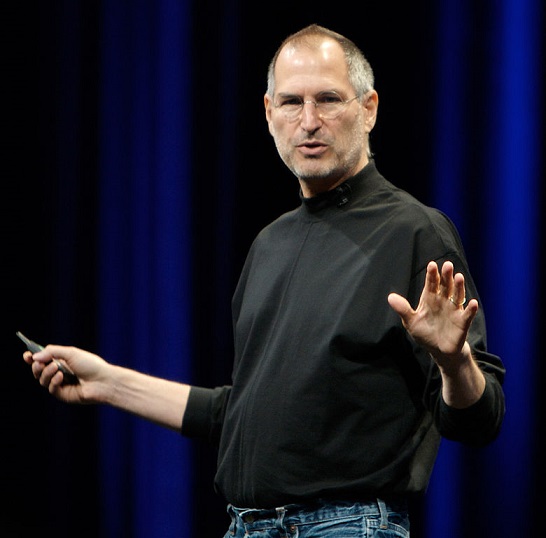

Have you ever seen pictures of Steve Jobs? He is always wearing the same-looking black turtleneck shirt and jeans. You can see him wearing this in the 1980s, 1990s, 2000s… If one of the most successful businessmen in this world was wearing the same clothes for 30 years, do you really need to buy so many different clothes?

Okay, you don’t need to be like Steve Jobs and wear the same clothes for 30 years but if you want to save some extra money, you can do it by not spending so much money on clothes. During the last 7 months, I have only bought a few socks so I have used less than $15 for clothes in total.

Imagine, that some people use $1,000 for clothes during 7 months.

How much do you spend on clothes?

5.Plan Your Trips Wisely

Even though you are saving +1000€ a month it doesn’t mean that you couldn’t travel. I know some people who are traveling all the time and saving thousands of dollars every month. There are also many ways to save money when you are planning your trip.

Many times you can save 20-30€ on a flight ticket by changing a date when you leave or come back from your trip.

Then you can also use cheaper ways to move from one place to another like Flixbus, BlaBlaCar and so on.

These tips can save hundreds (or thousands) of euros during a year if you are traveling a lot. But you can save even more if you choose your accommodation wisely

6.Airbnb & Couchsurfing

I don’t even remember when I would have paid myself for the hotel. In 2015 I spent one month in Paris and the accommodation cost 0€ even though I didn’t know anyone there before my trip. Actually, the whole one-month-trip in Paris (with one weekend in Brussels) cost less than 850€ including 240€ flight tickets. Even though people say that Paris is one of the most expensive cities on Earth.

Airbnb is a wonderful website and service where you can “rent” someone’s home or room for a few days, one week or even for a month. It’s ultimately flexible and much cheaper than a hotel. Most of the time it’s also much more comfortable than a hotel because you can choose in what kind place you wanna stay. You have also more space, more tools to cook and more freedom than in a hotel.

Couchsurfing is a website where you can find people who are willing to host travelers at their home (link in the beginning of this sentence takes you to the post where I explain more about Couchsurfing on my other website). Don’t get scared, they are just normal people like you and me. It’s a wonderful way to travel cheap and get to know local people at the same time.

I have used Couchsurfing many times when traveling around and my experiences are mostly very positive. When I visited Jakarta, almost 50 people offered their home for me. When I was in Paris, I met a French millionaire who took me to the French coast to meet his pilot friend and a restaurant owner. I seldom eat so delicious food like we ate there!

But of course, you need to be careful sometimes. You can always read references of the hosts from former visitors. They give a good picture what kind of person there is waiting. It’s also polite to bring a little gift to your host when you go there.

7.Do You Really Need All the Gadgets?

When we are kids, we ask our parents to buy us new toys. But when we grow older, our toys become more expensive. New iPhone, new car, new yacht and so on. Do we really need all these stuff? When I was moving from Finland to Austria 7 months ago, I realized that I only need a very little amount of stuff in my everyday life.

I spent my money according to Robert Kiyosaki’s famous book Rich Dad, Poor Dad. There he explains the difference between assets and liabilities.

Assets are things that bring money into your pocket, for example, a real estate or a stock investment. Liabilities take money from your pocket each month, for example, a car, a mortgage, new clothes and so on.

Spending money on your education can also be an asset because it brings something important value to your life. But buying useless stuff that we really don’t need is a liability. Instead of buying a big house for myself, I bought one and rented it and then rented a small one for myself.

Now I get my living “for free” because my asset (=my investment apartment) covers the money that my liability (=the apartment where I live) takes from my pocket.

I hope you understood the difference between assets and liabilities. It’s a highly important thing if you want to learn to manage money well. If you have any questions about it, I recommend leaving a comment below.

Conclusion – Your Decisions Matter

Many of these 14 tips may be relatively small decisions. But they will have a big impact on your life in the long run. Even a small 1% change in your life can create a huge difference if we go 10 years forward.

What do you think? Is saving 1000€ a month so challenging after all?

In my opinion, saving 1000€ is easy. I have just laid out the formula how you can do it yourself. Now somebody may ask me, “If it’s really so easy, why don’t everybody do it?” My answer is: I said that it’s easy to do. But on the other hand, it’s also easy not to do. That’s why some people don’t do it.

What is your decision? Are you going to make small positive changes in your life that can a huge impact in the long run?

Money and stuff don’t buy happiness. I am happy living in a small apartment because it’s very practical for me right now. I don’t need to eat out every day or even every week because I enjoy food what I can buy from the supermarket.

When you have saved some money, it gives you a freedom to travel, spend your time the way you want, give to charity, buy gifts for your loved ones, make an impact in the world and so on.

I would love to hear from you.

What did you like these practical tips? Do you find them useful?

I can save 40$ a month and it is equivalent to 2000 in the currency here in my country. It is already a big savings per month for a student like me. It is hard to save money every day because I have to pay food for my self every day and sometimes there is some school projects that I have to pay too. But thankfully I can still up to 40-50$ a month.

I see. A positive thing is that you save something. By investing it further, you can increase your income to save a bigger amount later and finally become financially independent? 🙂

My entrepreneurship teacher once told us that we don’t need to wait for us to have a good income from our job, because as long as you are earning no matter how big or small it is you can save, it is just depend on the peoples choice if he or she wants to save money to prepare for the future or keep on spending. Of course we will definitely choose saving right?

Yes, that’s also true. There are many paths to becoming an entrepreneur.

For the ones who can read this, always think for your future. Save for your future. You don’t need a strong study background of becoming an entrepreneur you just need to know the correct principles of becoming an entrepreneur. Specially now that internet already plays a big role in business world.

Hi Roope

What a fantastic site. I really like how you get straight to the point and don’t waste time with fluff in your writing. Very, very useful tips on how to save money and how to increase income.

The banner at the bottom right corner of your pages is a bit of distraction for me. I suppose that is the point of it, to get your attention as the visitor.

Love the social media marketing tool page.

All-in-all a great site and I’ll be sure to look in again if you were to put up more tips on saving maybe for teens or kids etc.

Keep up the good work and best of success in future.

Rudolph

Hi Rudolph,

thank you very much for your positive feedback. I will take a look at the banner in the bottom right corner and probably do something about it.

That’s a good idea to put also saving tips for teens and kids. We learn how to use money when we are children.

I am glad that you enjoyed the site. Welcome again and feel free to share it with your friends through social media 🙂

I wish all the best for you!

Roope

I am always a littler weary when a site online tells me how to make money…however your first paragraph definitely described me which had me hooked instantly.

After that I was eager to continue reading and find out how to fix my situation. Oddly enough I was already doing a few of the tips you posted (affiliate marketing currently). I thought it was very informative and gave good tips on how to fix the situation.

Hi Kerry,

I am glad that you enjoyed the article. It’s good to know that you are already doing some of the same tips.

I think that becoming a millionaire, for example, is quite simple. You just need to do specific things and over the time course “the magic” happens. Brian Tracy always says, “If you do what other successful people do, you will eventually become successful as well.”

Cheers,

Roope

Hi, Roope.

Thanks for this great article.

It really gave me a lot of insight into the common expenditures we take for granted. All I ever thought about was how much I spent on gas but it’s strange to think about all the expenses you actually incur while owning a car. It’s given me a lot to consider.

You mentioned ‘investing in the stock market’, are there any websites that you know of that could help a beginner get into it? It seems pretty overwhelming.

Hi Ryan,

yeah, I realized the expenses of the car when I was first time considering to buy it. I think that I will not probably buy a car before I have enough passive income to fully cover all the expenses.

I haven’t search so much about stock market investing on the Internet but I can recommend a few helpful books. I learned to invest by reading books and listening to teachings and talking to more experienced investors.

I can recommend these ones to get started:

1.The Intelligent Investor by Benjamin Graham. This book is written by the mentor of the most successful investor of all time (Warren Buffett). Many people say that it’s the best investing book ever written.

2.Building Wealth in the Stock Market: A Proven Investment Plan for Finding the Best Stocks and Managing Risk: Colin Nicholson. One experienced investor recommended me this one but I didn’t read it yet because I focus more on Finnish books. (I am from Finland so my focus has mainly been in the Finnish stock market.)

3.Rich Dad, Poor Dad by Robert Kiyosaki. This is a classic and it will give you lots of tips to have the right mindset of the investor. It doesn’t give very specific tips for some stocks but it helps you to become a better investor for sure.

Would you like to read some of these?

Cheers,

Roope