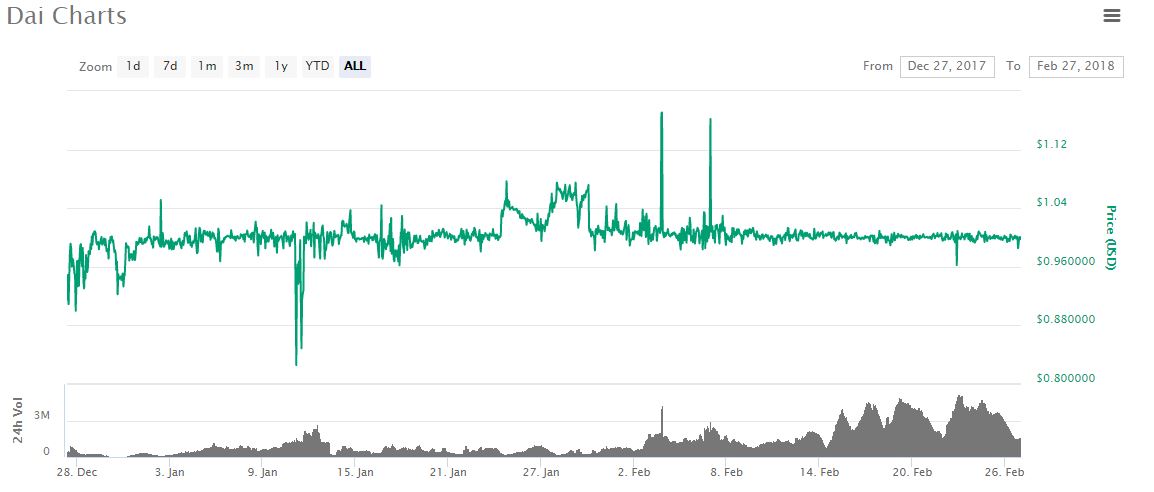

Normally the cryptocurrency articles here cover potential investments. DAI, however, stays firmly priced at 1 USD. What makes it so special, then? DAI is the first decentralized stablecoin and also the first one that has legitimate backing. Read on to find out how.

Is Dai Legit? – My Video Review

DAI Stablecoin Review

Name: Dai

Launched: 17th December 2017

Type: ERC-20 token, price stable at 1 USD

Short Review: DAI is an ERC-20 token built upon a complex, decentralized backing system that ensures its price is fixed at 1 USD. Anyone can create new DAI by locking cryptocurrency within a smart contract. The cryptocurrency can be freed by paying the same amount of DAI and a small interest. DAI possesses the most robust technology out of all current stablecoins, avoiding the pitfalls of Tether.

You can use Dai to make more money with cryptocurrencies if you can predict market movements well..

What Is Dai?

DAI is the primary product of the Maker/DAO Project. The online Maker Platform allows users to create new DAI by locking cryptocurrencies in their smart contract as collateral used to back up the stability of DAI. The Maker platform has many means available to keep the price of DAI stable. Currently, the price of DAI is 1 USD and every DAI is backed by at least 1.5 USD worth of Ethereum.

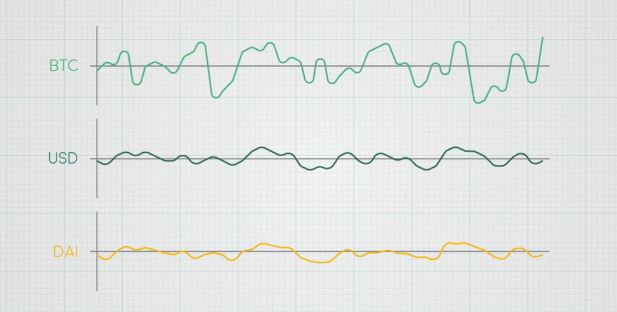

The price of cryptocurrencies go quickly up and down so stablecoins like Dai and Tether want to provide an opportunity where you can hold your cryptocurencies in a stable way instead of transferring your money into fiat currencies.

How Does Dai Work?

There are multiple mechanisms in place to keep the price of DAI stable. Here I will briefly go through them all.

1. Collateralized Debt Position (CDP) Smart Contracts

To create new DAI, a user must send cryptocurrency into a special smart contract using the Maker platform. Currently, only Ethereum is supported (Dai v. 1.0), but later versions during 2018 aim to allow other cryptocurrencies as well, like Bitcoin or Bitcoin Cash.

Within the smart contract, the cryptocurrency can be converted (or “wrapped”) into an ERC-20 token, which allows it to be used within the Maker platform. The ERC-20 token corresponding to Etherum is “Wrapped Ethereum”, ticker W-ETH. W-ETH has used on its own: in addition to its use on the Maker platform, it can be traded for other tokens on two exchanges: Oasis DEX and Radar Relay. Later when other cryptocurrencies can be wrapped as well, those exchanges will see much more traffic.

Within the Maker platform, W-ETH can be deposited into the collective cryptocurrency pool that backs the DAI stablecoin. This turns the W-ETH into P-ETH (“Pooled Ethereum”). The P-ETH token denotes the holder’s share of the whole collateral pool within the system.

P-ETH can be “locked” by creating a CDP within the Maker system. This allows for the creation of new DAI. The user can “draw” new DAI from a CDP up to 2/3 of the value of the P-ETH locked within the CDP. Managing CDPs is kind of complicated, but it boils down to 1) If the value of ETH goes up, the CDP can be used to create more DAI. 2) If the value of ETH goes down so much that the locked P-ETH is worth less than 150% of the amount of DAI drawn, the system automatically sells some or all your P-ETH to cover the debt and a penalty fee.

2. Target Rate Feedback Mechanism (TRFM)

The Target Price of DAI is currently set at 1 USD. If the price of DAI on exchanges changes from that amount, the Target Rate Feedback Mechanism activates.

If the price of DAI rises above 1 USD, TRFM activates, causing generation of DAI with P-ETH become less expensive (less collateral needed to generate new DAI). This encourages a generation of new DAI, thus increasing supply and decreasing the price of DAI back to the target price of 1 USD.

Vice versa if the price drops below 1 USD, TRFM causes generation of DAI to become more expensive (more collateral needed to generate new DAI). This causes the circulating supply of DAI to diminish as people hold the coins waiting for the price to increase instead of generating new DAI, causing the price to rise.

The parameters for activating TRFM, that is, how much the price needs to drop or rise for the mechanism to activate, are set by the owners of the Maker Token (MKR). I will write an article on MRK in a few days.

3. Global Settlement

This is the dramatic last-resort mechanism used to guarantee the target price of 1 USD.

A group of people elected by the Maker Token holders can initiate a global settlement, but activating it without a good cause hurts the value of their own holdings (more on this in the upcoming MKR article). Good causes include strong external price manipulation, a rapid (more than 33%) drop of the value of ETH or technical upgrades to the system.

When a Global Settlement is called, the price of ETH is frozen in place, and CDPs cannot be utilized in any way until the Global Settlement is over. Every CDP owner and DAI holder can withdraw ETH from the Maker platform equal to the value of their W-ETH, P-ETH, and DAI at the time when Global Settlement was initiated. There is no time limit for this. The Global Settlement essentially guarantees the price of DAI at 1 USD in times of crisis via freezing all assets inside the system.

Risks of DAI

1. Tether

Why would people use a complex system like DAI when they can use a more widely-used stablecoin, the USD Tether (USDT)?

There is a minor and a major reason for that. The Maker platform allows for leveraged investing in ETH via the CDP system in a completely decentralized environment, which is a new, original idea. The DAI token hence provides more utility than only the stability.

The major reason for using DAI over USDT is transparency.

Only an unknown fraction of USDT is backed by existing assets. Its value is mostly tied to widespread use. If the trust in Tether is broken, causing a bank run, investors will lose money. Meanwhile, DAI is over-backed (150%) and has multiple systems set in place to guarantee that owners of DAI can convert their DAI to dollars themselves if they wish to do so.

2. Hacking

As an ERC-20 token-based system, the Maker platform shares possible vulnerabilities with Ethereum. The code will be fully reviewed by external auditors in the future according to the project roadmap.

Dai Team

The DAI coin runs mostly on an automated, decentralized system. It is overseen by owners of the MKR token, called Makers. More on this in the MKR token review, released in a few days.

Dai Community

Reddit: 3k

Twitter: 6k

Is DAI Worth Buying?

As a stablecoin, DAI is very much alike Tether in its uses. Check out Roope’s review of Tether here.

DAI is less widely used for trading than USDT. At the time of writing this, only a few decentralized exchanges like ForkDelta, IDEX, Radar Relay or OasisDEX (The Maker Platform’s own DEX) and a single centralized exchange (Bibox) had DAI trading pairs.

On the other hand, DAI is much safer than Tether in the rare Black Swan event of Tether collapsing. If Tether would crash, it could attract more users to DAI, which in turn would boost its development and grossly increase the price of the Maker coin, MKR.

Additionally, the CDPs on the Maker Platform can be used to do leveraged purchases of ETH. That is an advanced, risky investing strategy: By creating new DAI, buying ETH with it and using that ETH to create even more DAI you can create a geometric series to double or triple your initial ETH.

Personally, I don’t see value in that because the risk for a 30% drop in the price of ETH is significant. However the option to do so exists, and the Maker Platform is currently the most advanced decentralized system for that.

Conclusion – Is Dai a Good Stablecoin?

DAI is one of the most interesting stablecoin projects so far, and one I would personally love to see overtake Tether. If a transparent and credible coin like DAI was widely used, crypto critics would have less basis for their FUD.

In itself, there is little reason to invest in DAI, but it is important to understand the technology behind cryptocurrency projects to correctly judge their long-term value. If you understand a complex system like DAI, you are well set on your path to cryptocurrency investing.

Note by Roope:

I believe that stablecoins like Dai and Tether are great steps towards the mass adoption of cryptocurrencies. I believe that almost anyone who has invested in cryptocurrencies in the long term already in 2018 or before will make huge profits over the time course.

If you want to learn to make money with cryptocurrencies, take my step-by-step course on Udemy.

If you want to learn other ways to earn money online, take a look at the list of online jobs that I have collected for you. My #1 recommendation is Wealthy Affiliate for several reasons. Their step-by-step training is wonderful for beginners who want to learn the system to earn good money online. Their community and tools enable you to make your breakthrough. Click the picture below to learn more about it and get started for free.

What do you think about DAI?

Does DAI being quite complicated hurt its potential usage?

DAI vs. Tether, which is one better?

Let’s discuss in the comments below! 🙂

(Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice.)

I have heard of DAI however, I have never tried myself. After reading this review, a question arised in my mind. If this crypto currency is a stable coin how can we make money by investing. For instance, if the price always stands at $1, how do we profit. Will the price increase later, or will it always stay the same.

I think it will always stay the same. Therefore, you will not make profit by holding DAI. The same applies to all other stablecoins, also Tether.

However, DAI is connected to Maker that enables you to make profit.

One thing that DIA and Tether brings to the table which I love so much is the stability in the price unlike the fluctuations which always rocks other cryptocurrency. This helps one keep a track on how his or her investment is going without the fear of losing money by sudden fall.

Well it’s good to hear that it will retained your $1 using DAI no matter values goes down. It will gives peace of mind for every bitcoin users in regards with this. The trending of BitCoin now is very in demand because online users are worldwide. Various platforms offers new marketing plan and easily attracts investors.

My question regarding stable coin: how can the value always stay same. I mean who will DAI always have $1 value. What stops it from going down or climbing up. Is this an artificial value or real value. In case it is real, what kind of technology makes it value stable? I will have to do a research and find answers to these questions.

I think Markus already explained that in the article above. Of course, I must admit that the system is a bit technical. DAI has also $1,5 worth of ETH to back up each $1 that they give.

On an honest note, I would have to say that DAI looks quite complicated to me and no matter how long I tried to make sense out of it, it doesn’t sink in. I would have to say that Tether is a more understandable cryptocurrency locker than DAI and considering the hacking fear of investing in DAI, I wouldn’t go with the option at this moment till my fears are allayed in the future.

I think that the risk of hacking in the case of DAI is extremely small. Anyway, I haven’t really used these stablecoins like DAI because I’ve been happy for just holding my cryptocurrencies that I’ve bought.

In as much as the risk is small, the important thing is knowing that there is that risk. Also, as you said, it seems to be better to hold the coins we have got instead of investing on some of the stable coins.

The truth is that no investor would be comfortable knowing fully well that his investment is likely vulnerable to agents of hacks. This normally kills the interest to go ahead with such investment, I would be completely honest, if I’m aware of such hack threat prior to any investment, I wouldn’t go ahead with it.

Are you saying that each coin is worth 1 dollar each? Because it says that it is fixed in one dollar. If I am correct this is a good way to earn. Because it is fixed in 1 dollar you dont have to worry anymore that it is possible to be lower than 1 dollar. And also it is awesome what a coincidence the founder is another mathematics teacher.

Well, DAI is not a way to earn because the price is always one dollar. Actually, the value of dollar steadily goes down in the long run and so goes DAI as well. That’s why holding DAI is good only for the short term when you are moving your cryptocurrencies.

Thanks Roope!! Now I understand it. DAI is only to secure your bitcoin and stay on the one dollar amount. So you dont have to worry that your bitcoin value will possibly goes down because you can assure that this will stay on its value which is 1 dollar. I will definitely share this to my friends that are bitcoin miners too.

Great to hear that you got it now 🙂