Today we are I am going to give you my personal review on my #1 recommendation for a brokerage firm.

If you want low costs, fast and reliable service and easy platform, then you may want to hear more about Nordnet Bank. I will also bust some myths about investing.

What is Nordnet Bank?

Nordnet Bank AB is a Nordic online bank and stock broker that provides service in Finland, Sweden, Norway and Denmark. The company is founded in Sweden in 1996 and today it’s biggest brokerage firm in Nordic countries. Nowadays they have more than 500,000 clients.

Is Investing Risky? That’s What I Thought Before.

“Poor people think that saving money is wise and investing is risky. But rich people think that investing is wise and saving is risky.” -Robert Kiyosaki

I thought before that investing is risky, it’s only for greedy people and that I shouldn’t be doing that. Then I talked with one of my good friends, read several books, blog articles and teaching videos about investing. I realized that my beliefs were false.

Investing is actually a good way to maintain your money and earn more. It’s not rocket-science but simple things that anyone can learn. Of course, there are many strategies for stock market investing but anyone can be profitable by buying and holding a well-diversified portfolio. If you don’t have a lot of capital, you can buy funds for 15€/month which will give you a diversified portfolio right away.

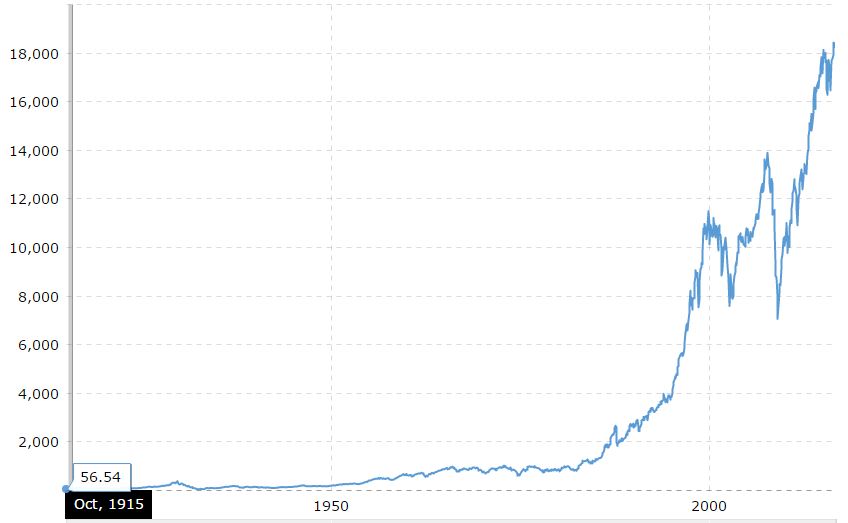

Buy and hold a reliable fund for 15€/month and you are already a profitable investor. It won’t make you rich but the more money you have, the more you will earn. Take all the ups and downs and in the long run, you will be profitable. That’s what 200-300 years of history have taught us. Stock index goes always eventually up, up and up. Check the image below!

The picture above illustrates you how much index goes up all the time. It has some downs during the years but over the time course, the trend is always up. That’s the reason why rich people think investing is wise! 😉

Why Nordnet?

There are many brokerage firms and banks out there where you could buy stocks, bonds, mutual funds and other investing products. When I was looking for a right one I was most interested in the companies that have low fees.

I saw that some banks take fees even for keeping your stocks. Some had lower prices when trading stocks and some had higher. Then I found Nordnet.

Their buying/selling fees are low, they don’t have any fees for maintaining the stocks and in addition, they have some funds with 0% administrative fees. Normally funds have 1,5-3% administrative fees which eventually take a big part of your profits but a fund with 0% fees is amazing.

Why have they that kind of fund?

Superfunds in Nordnet

Nordnet’s so-called “SuperFunds” take 0€ administrative fees. You read right. 0€. 0%. Zero!

They are not earning anything with that fund but the idea behind it is to get more clients. They believe that people will eventually their other service which will bring money in. With those funds, they are actually losing some money but they have calculated that it’s profitable for them because many clients buy their other products.

For example, I bought only shares of Superfunds in the beginning but after a while ended up buying other stocks which benefit Nordnet because they earn some administrative fees.

There are 4 Superfunds:

- Finland’s Superfund

- Norway’s Superfund

- Sweden’s Superfund

- Denmark’s Superfund

All funds make up a well-diversified portfolio. For example, Finland’s Superfund consists of the biggest companies from Finland: Sampo, Kone, Nokia, UPM-Kymmene etc. Superfunds are literally GREAT!

Prices in Nordnet

As I mentioned before, they don’t take any monthly fees for maintaining your money.

Trading fees depend on how much you have been trading in the last month. The lowest level is 0,06%/Min.3€ and the highest level is 0,20%/Min.9€. It means that in the lowest level you have to pay at least 3 euros per trade or 0,06% per trade.

As you can see, the more you trade, the lower price you will have. Even though you wouldn’t trade a lot of fees are not very high. With 0 trades/month, your trading fee is 0,20%/Min.9€. I don’t trade stocks almost at all because I use “buy and hold” -strategy and I am satisfied with Nordnet’s prices.

Prices are a little different depending on which country you are buying and selling stocks but you will find all their prices on their website.

Nordnet’s Investing Training

Nordnet provides many kinds of training that teaches you some principles about investing to the stock market. They have blogs, podcasts, expert articles, and webinars.

I have used all of their content and it has been mostly very informative. Some expert articles can give good insights even for very experienced investors. But be aware that all their thoughts are just opinions and you must never 100% rely on someone’s opinion. You make investment choices. You take the responsibility.

Their webinars teach for example following subjects

- How compound interest works

- What do different numbers (e.g. P/e) mean

- How much tax you must pay

- How to get started

- and much more.

My Final Opinion on Nordnet

If you live in Nordic countries and you are interested in investing, I can recommend Nordnet for you based on my own experiences. I have never had any problems with their website, customer service or with anything.

Let the money work for you. Create an account to Nordnet!

Investing seems to be a wise way to maintain money against inflation and to earn more without much effort. The more you learn, the more you earn. That’s usually how it goes with investing. But if you want to invest, you need some money to get started. You can’t start investing with 0€.

If you are interested in making money online, I would recommend heading to Wealthy Affiliate. They have a comprehensive training that teaches step by step how to build your very own online business from the scratch. It really seems to work. Read these 5 examples of people who started earning +$10,000/month with their skills learned from Wealthy Affiliate.

My dream is to be able to earn money online. Then I could invest the money in the stock market or to real estate and live anywhere in the world, for example, in Asia. Interested in the opportunity? Start free training!

What Kind of Reviews Do You Want?

This is our first review about a brokerage firm on YourOnlineRevenue.com. We have now made reviews on:

- “Make money online” training products

- Domain hosting programs

- Mobile apps to make money online

- Brokerage firm

You can find all our reviews here. Here is the review of our #1 rated product (98/100).

Let us know what kind of reviews you would like to have more in the future.

Or would you like to have more tutorials and tips to make money online? Please let us know in the comments below!

Hi,

Thanks for the review and valuable info. I am not clear on whether you can open an account from the U.K., meaning in GBP currency. If not- do you know of any other similar companies that would offer low fees in the U.K. that you would recommend ?

Thanks

Hi M,

I am not 100% sure about U.K. stock brokers. You can try to create an account on Nordnet but I am not sure how it works for U.K. citizens.

By the way, because you are from U.K., I would like to introduce you to OddsMonkey and Profit Accumulator.

Check out those links and you’ll see my full reviews of those platforms. They are designed for people in the U.K. who want to make a good money online. I bet you’ll find them helpful. Just let me know if you have any questions about them.

I don’t live in Nordic country. I am from nepal, can I invest on Nordnet and benefit from this investment company? When you say this is a legit way to make money, I believe you. I believe you don;t make money for free. You need money to make money. I am willing to invest in Nordnet, am I eligible.

Nordnet is a stock broker. Unfortunately, you won’t be able to use from Nepal, I think.

But I recommend that you look for local opportunities. I am 100% sure that you have opportunities there as well. I just Googled “Nepal stock exchange” and found something interesting. Nepal stock exchange seems to be pretty small but you can also find a local stock broker and buy stocks from the U.S., for example.

hi,

I discovered your audit on Nordnet extremely fascinating. It is decent to see a money related organization charging no expenses. This is an irregularity and something that ought to be accepted by additional!

I like that you can contribute as meager as Euro 15 to begin. Do they have particular supports that they put resources into or does the financial specialist have a component of control in the decision?

much appreciated

Hi Central Zone,

Those funds with no costs invest into biggest companies in that stock market. For example, biggest companies in Finland, Denmark and Norway. Then they will get more or less the same profit like the index.

Not all of their service is free. You can choose if you want to use only their free service or also use other services. I use both because their fees are also very low in stock market investing.

I never heard of this place but I love what they have to offer. Is there any places like this for US/Canada areas? As for your question, I would love to read more reviews on mobile apps and domain hosting. I run a blog and help manage a few forums. I would love to learn how to earn from these but I haven’t a clue. I think reviews like those can help me out.

Hi Britanica,

yes, there are many stock brokers in US/Canada area but I haven’t used them myself because I am living in Europe. If you are interested in investing in US or Canada, I would ask your friend or read reliable sources on the Internet which sites are the best for stock market investing. The biggest banks and brokers are often very reliable but they may have high fees.

Thank you for your feedback and ideas. If you want to earn money with a blog I can definitely recommend to go to Wealthy Affiliate. They have a step-by-step training that teaches you how to earn money with your own blog. You can also connect with very successful bloggers and Internet marketers who are earning big income online. They will take a look at your blog and give personal advice.

Hello,

I found your review on Nordnet very interesting. It is nice to see a financial company charging no fees. This is a rarity and something that should be taken on board by more!

I like that you can invest as little as Euro 15 to start. Do they have specific funds that they invest in or does the investor have an element of control in the choice?

thanks

Hi Neil,

Yes you are right that their fund with no fees is awesome! And it should be used more. Because I think it’s also good for the company when it gets new customers. But of course they have fees on most of the funds and when you are trading stocks as I mentioned in the text.

You can of course choose where do you want to invest. They just offer you many products/funds/stocks that you can buy/sell and then you make the choices. Buying and selling is really easy and practical in Nordnet. I never had any problems with it.

-Roope

Hello Roope. Thanks for the great great review on Nordnet Bank! I’ve always wanted to invest in something either stocks or mutual funds but our financial market here in West Africa is still growing and I am not so enthused about some of the share price movements on the market.

Is it possible for me to make investments from my side of the world into markets outside my borders without fearing the loss?

Hi Stornyi,

I’m glad you liked the review. I believe that the situation in the stock market must be very different in West Africa than for example in Finland or U.S. As you said economy is still growing in West Africa. There could be good chances to make good profits in such a place but it also contains some risk.

I don’t know about West African’s regulations but I guess that you could open an investing account and start investing to U.S. market. Of course, there is always some risk in investing but the higher risk can be just let your money be in your bank account when inflation takes value from your money day by day. 😉

My recommendation would be to open an account in some brokerage firm. Start slowly, don’t push all your money right away. Make a plan. Buy well-diversified funds with low administrative fees.

I hope this helps 🙂